Long call strategy

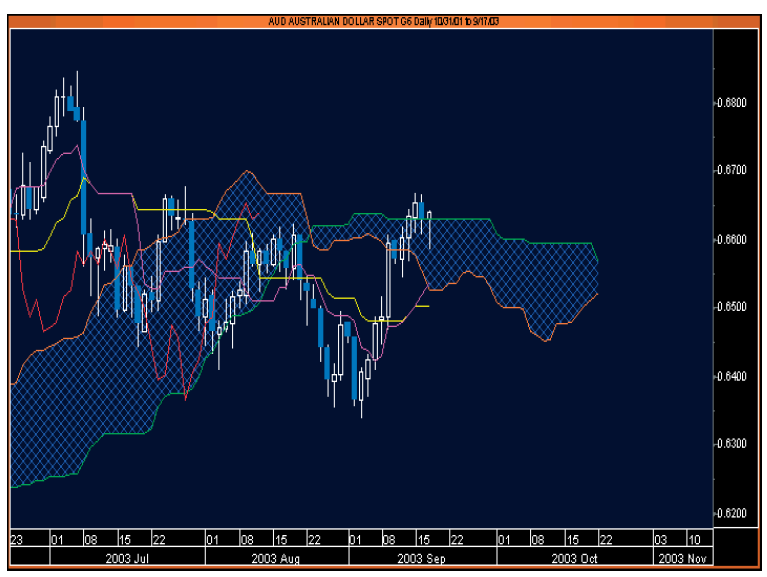

This is a good example for a cautious trader who wants to buy an out-of-the-money option. In this example the investor anticipates that the Australian dollar would increase in value versus the US dollar. The chart is of the number of US cents needed to buy oneAussie dollar (the level here is 0.6650, so 66 1/2 US cents). The higher the price, the stronger the Aussie. Believing it should move higher, the trader therefore wants to buy an Aussie call (the same thing as a US dollar put).First, check the Cloud and make sure the candlesticks are above the Cloud. If they are not: wait, as a lot of time value may be eroded as prices can stick under the formation for several weeks.

Here the Aussie dollar did for almost two months! If they are nudging into the Cloud, and the trader really cannot resist the urge to buy, choose a call with a strike at the top edge of the Cloud and preferably above it (to the nearest round number as these are more actively traded and therefore more keenly priced). Here I would probably look at 0.6600 or 0.6700 calls. As prices break above the top of the Cloud they are likely to start moving quite quickly, increasing implied volatility and thus adding value to the option.

This call can be held until expiry, so long as prices do not break below the bottom of the Cloud. If they trade down below this line, it will probably be worth selling the option in order to recoup some time value and possibly higher implied volatility. Note: as and when prices move higher, so does the Cloud. It continues to provide support as the market rallies and can be used as a trailing stop.Many traders do not think about selling their options, especially in-the-money ones. But if you want increased profitability you should re-assess positions continually to make sure you have the best strategy for current market conditions.

Long put strategy

In this next example, a trader wants to buy a put on the dollar versus the Korean won as the market should hold below the Cloud formation. This one is quoted the European way, as won per US dollar, so the lower we go, the fewer won you need to get yourself a US dollar.First, make sure the Cloud is thick, rather than the lines crossing over within the next 26 days. Not quite the case here, although they have not crossed, but it is difficult to find perfect examples in current markets, and I always prefer to use up-to-date examples rather than historical ones. So, as this trade assumes the bear trend will continue, the Cloud should be fat to keep this trend heavy and steady.

Next, check that Chikou Span is below the candle of 26 days ago and below the Cloud. Yes, the red line is well below. Buy a put with a strike just below this level, thereby increasing the chance of buying an option that is likely to move into the money quickly. If the trader is correct, then the two Cloud levels should come lower over the life of the option. This time the upper level is used to cut the position to minimize premium losses. Review levels constantly.

A similar, if more elegant strategy when buying options could be achieved with a knock-in which tends to be a lot cheaper than a conventional option. It is an option that only comes into existence when a pre-agreed price level is reached. Premium is paid up front, on the day of purchase, but if the knock-in level is not reached it never becomes a live option. For calls, the knock-in is usually below the current price and well below the strike price; vice versa for a put.

Knock-in strategy

A trader who is bullish on the Euro versus the US dollar but the market remains below the Ichimoku Cloud could do the following:Buy an out-of-the-money call with a strike at the upper edge of the Cloud, say 1.1600.Alevel below the current price and at the lower edge of the Cloud is used as the knock-in price, say 1.1000. A minimum of one week, more realistically up to one month, should be used for the knock-in period; this for an option that has three months to expiry.

So, the option is very much cheaper than a straight call as the market

1. may never drop to the knock-in before rallying (which was the case here), or

2. may reach this level after the knock-in period has expired (and so the option never comes into existence).

A similar strategy would be a reversal knock in. As we are currently below both levels of the Cloud in the Euro example above, the knock-in could be at the lower Cloud level and the strike above the top of the Cloud.

While neat, this strategy would not really save you very much money and certainly not nearly as much as using the standard knock-in described above.

Knock-out option strategy

A knock-out option strategy would again make the option slightly cheaper. This is an option which exists from day one, but then ceases to exist (or dies) if a pre-determined price is touched. For this example I am using Sterling versus the US dollar; the lower the price the stronger the dollar.I would suggest the following because the current price is below a decent-sized fat Ichimoku Cloud. Buy an at-the-money put on the pound (a call on the dollar) at 1.6000. Use a level well above the upper edge of the Cloud and above Chikou Span as the knock-out level, say 1.6400. To make money Cable (the USD/GBP rate) would never hit 1.6400 and drop steadily from current prices.

So, if the market went against the trader’s strategy (which was the case here), his option would cease to exist as prices break above the top of the Cloud. The most important thing is that the knock-out makes the option cheaper to buy in the first place.

Window knock-out/knock-in strategy

This is my last strategy involving only the purchase of options. This is a Window knockout/ knock-in which capitalizes on the timing aspect of options and Ichimoku Kinko. Windows are options where the knock-in or knock-out elements are shorter than the expiry of the option and are for a pre-selected window of time, say a particular fortnight in the first part of the life of the option. These are even cheaper than straight knock-ins/outs in that not only must the trigger level be hit but it must be hit within the right time frame.To illustrate this example I shall use the US dollar versus the Japanese Yen, again quoted the European way as Yen needed to buy one dollar: the higher the price the weaker the Yen.

In an ideal world it is nice to see sharp price swings initially, as these would trigger the knockin (but might just kill it dead as too!), followed by steady moves later on where you don’t have to worry about your option unexpectedly expiring on you.

The idea is that, ahead of the Cloud becoming very thin, the investor buys the option assuming that there will be fairly sharp moves at the thin point and eventually a change in trend. Once the new trend has been established, one wants to run the trade and not worry about getting stopped out. In this example I have assumed that we shall be getting some very sharp moves around mid-October, and that we shall eventually get a turn in the long term trend and that dollar/Yen will eventually move up towards 130.00 around year-end.

The key element of this strategy is that we want to buy a three-month dollar call as our long term view is for a stronger US dollar versus the Yen. Say a three-month at-the-money call at 122.00. Why here? This level is above the top of the Cloud and just above August’s high at 121.50. Because implied volatility is likely to increase in mid-October, I have taken the view that it is better buy it now rather than wait and have to pay more premium.

The next step is to reduce the cost, which I can do via a knock-in for the two weeks around 10 October - which is the thinnest bit of the Cloud as

1. you should not be too greedy, and

2. the knock-in is saving such a lot of money that there is some leeway on the choice of trigger price. Above 118.00, so let’s settle for 119.00.

As for a knock-out, I think that if dollar/Yen broke to a new low for the year, I should probably abandon this whole idea, so let’s add a 115.00 knock-out, lasting for the first month of the option. Again, this will reduce the premium I have to pay on day one when I enter into this trade.

Premiums are so much lower with these add-ons, because I am giving away optionality – I am betting against the trend. The cost of this strategy is as follows:

1. For a straight three-month 122.00 the call premium would be 1.8%.

2. The same strategy using a two-week knock-in at 119.00 for the middle two weeks in October reduces the cost of the call to 0.32%.

3. To the above we can add a one month knock-out (for the first month) at 115.00, reducing the cost of the option yet further, to 0.16%. Less than one tenth of the price of a conventional call, which is not an inconsiderable saving.

Comments

Post a Comment